How to Manage Your Monthly Household Budget

| Jan 31, 2017

Mortgage, food, utilities, day care, car payment… the list of expenses each month is never ending! If you’re having trouble keeping your typical household costs on target, you might find it easier to create a monthly household budget to keep track of expenses.

Having a budget for every month is a simple way to see how much the breadwinners are bringing in and how much is going out to pay for items and services. Once you create your first monthly budget, you’ll be able to get an estimate of how much funds you will need to pay for things each subsequent month.

Easily Keep Your Monthly Household Budget on Track

First, determine how much you and/or your partner makes each month after taxes. Add up your pay stubs from a recent month to get the monthly total income.

Next, start itemizing every expense. List all of your utilities, rent/mortgage, car payment(s), child care, private school, lessons, tutoring sessions, gym membership, etc. You may even need to take into account alimony or child support if those expenses aren’t automatically withdrawn from your paycheck. How much food and vehicle gas do you typically use each month? To find out, keep your receipts for at least one month and then add up the food receipts and gas station receipts. If some expenses are paid on a quarterly or yearly basis, divide that out by month or make sure you include the expense for just those months.

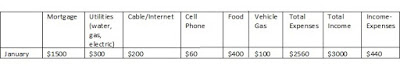

Now that you have all of this information, mark it down in a ledger or enter it into an Excel spreadsheet. List each month vertically down the page or spreadsheet. Then record each expense by name horizontally. You could even group expenses in categories—fixed, variable, and discretionary—to give you a clearer picture of where your income is going. For example, are you spending more on discretionary items, such as a gym membership, or is a fixed expense, such as your mortgage, greatly depleting your monthly income?

Add all of the expenses across the row and enter the total in the third to last column. This number is what you need each month for your expenses. Of course, some months’ requirements may vary depending on vacations or unforeseen expenses. But if you plan ahead, you should be able to get a good estimate of monthly funds needed. The second to last column should be your total monthly income. Subtract your income from the expenses and enter this number in the final column. If your expenses are greater than what your income is, this will be a negative number.

Sample Monthly Budget

Plan for Financial Stability

Once you have this initial monthly budget, you can revisit the expenses to see if you need to cut spending and where to cut it (if possible). This budget can also help you with long-term financial goals. Do you want to pay off your student loans, increase your retirement savings, or go on a coveted vacation? Maybe the gym membership, pricey cell phone plan, or monthly massage could be cut to make way for these goals. By looking at each area of your spending, you can make adjustments to keep your budget on track.

Let us know below or on social media if you have a monthly household budget. If so, has it helped with your short- or long-term financial goals?